A) Rachel has a taxable gain of $180,000.

B) Rachel has a taxable gain of $170,000.

C) Rachel recognizes no gain on the transfer.

D) Rachel has a basis of $350,000 in the additional stock she received in Cardinal Corporation.

E) None of the above.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When incorporating her sole proprietorship, Samantha transfers all of its assets and liabilities.Included in the $30,000 of liabilities assumed by the corporation is $500 that relates to a personal expenditure.Under these circumstances, the entire $30,000 will be treated as boot.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Kim, a real estate dealer, and others form Eagle Corporation under § 351.Kim contributes inventory land held for resale) in return for Eagle stock.The holding period for the stock includes the holding period of the inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rhonda and Marta form Blue Corporation.Rhonda transfers land basis of $55,000 and fair market value of $180,000) for 50 shares plus $20,000 cash.Marta transfers $160,000 cash for 50 shares in Blue Corporation.

A) Rhonda's basis in the Blue Corporation stock is $55,000.

B) Blue Corporation's basis in the land is $55,000.

C) Blue Corporation's basis in the land is $180,000.

D) Rhonda recognizes a gain on the transfer of $125,000.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If a corporation is thinly capitalized, all debt is reclassified as equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Joe and Kay form Gull Corporation.Joe transfers cash of $250,000 for 200 shares in Gull Corporation.Kay transfers property with a basis of $50,000 and fair market value of $240,000.She agrees to accept 200 shares in Gull Corporation for the property and for providing bookkeeping services to the corporation in its first year of operation.The value of Kay's services is $10,000.With respect to the transfer:

A) Gull Corporation has a basis of $240,000 in the property transferred by Kay.

B) Neither Joe nor Kay recognizes gain or income on the exchanges.

C) Gull Corporation has a compensation deduction of $10,000.

D) Gull capitalizes $10,000 as organizational costs.

E) None of the above.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Employment taxes apply to all entity forms of operating a business.As a result, employment taxes are a neutral factor in selecting the most tax effective form of operating a business.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Tina incorporates her sole proprietorship with assets having a fair market value of $100,000 and an adjusted basis of $110,000.Even though § 351 applies, Tina may recognize her realized loss of $10,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

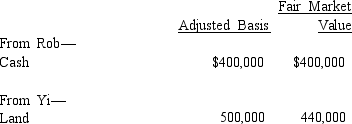

Rob and Yi form Bluebird Corporation with the following investments.  Each receives 50% of Bluebird's stock.In addition, Yi receives cash of $40,000.One result of these transfers is that Yi has a:

Each receives 50% of Bluebird's stock.In addition, Yi receives cash of $40,000.One result of these transfers is that Yi has a:

A) Recognized loss of $60,000.

B) Recognized loss of $20,000.

C) Basis of $460,000 in the Bluebird stock assuming Bluebird reduces its basis in the land to $440,000) .

D) Basis of $400,000 in the Bluebird stock assuming Bluebird reduces its basis in the land to $440,000) .

E) None of the above.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adam transfers cash of $300,000 and land worth $200,000 to Camel Corporation for 100% of the stock in Camel.In the first year of operation, Camel has net taxable income of $70,000.If Camel distributes $50,000 to Adam:

A) Adam has taxable income of $50,000.

B) Camel Corporation has a tax deduction of $50,000.

C) Adam has no taxable income from the distribution.

D) Camel Corporation reduces its basis in the land to $150,000.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Don, the sole shareholder of Pastel Corporation a C corporation), has the corporation pay him a salary of $600,000 in the current year.The Tax Court has held that $200,000 represents unreasonable compensation.Don must report a salary of $400,000 and a dividend of $200,000 on his individual tax return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In order to encourage the development of an industrial park, a county donates land to Ecru Corporation.The donation results in gross income to Ecru.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary transfers a building adjusted basis of $15,000 and fair market value of $90,000) to White Corporation.In return, Mary receives 80% of White Corporation's stock worth $65,000) and an automobile fair market value of $5,000) .In addition, there is an outstanding mortgage of $20,000 taken out 15 years ago) on the building, which White Corporation assumes.With respect to this transaction:

A) Mary's recognized gain is $10,000.

B) Mary's recognized gain is $5,000.

C) Mary has no recognized gain.

D) White Corporation's basis in the building is $15,000.

E) None of the above.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Eagle Company, a partnership, had a short-term capital loss of $10,000 during the current year.Aaron, who owns 25% of Eagle, will report $2,500 of Eagle's short-term capital loss on his individual tax return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the "check-the-box" Regulations, a two-owner LLC that fails to elect to be to treated as a corporation will be taxed as a sole proprietorship.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Donald owns a 45% interest in a partnership that earned $130,000 in the current year.He also owns 45% of the stock in a C corporation that earned $130,000 during the year.Donald received $20,000 in distributions from each of the two entities during the year.With respect to this information, Donald must report $78,500 of income on his individual income tax return for the year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct regarding the taxation of C corporations?

A) Schedule M-2 is used to reconcile net income computed for financial accounting purposes with taxable income reported on the corporation's tax return.

B) The corporate return is filed on Form 1120S.

C) Corporations can receive an automatic extension of nine months for filing the corporate return by filing Form 7004 by the due date for the return.

D) A corporation with total assets of $7.5 million or more is required to file Schedule M-3.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When consideration is transferred to a corporation in return for stock, the definition of "property" is important because tax deferral treatment of § 351 is available only to taxpayers who transfer property.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The receipt of nonqualified preferred stock in exchange for the transfer of appreciated property to a controlled corporation results in recognition of gain to the transferor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A shareholder's holding period for stock received under § 351 can include the holding period of the property transferred to the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 128

Related Exams