A) Domestic producers of the imported good being harmed

B) Domestic consumers of the imported good being harmed

C) Prices increasing in the importing country

D) Prices falling in the exporting country

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

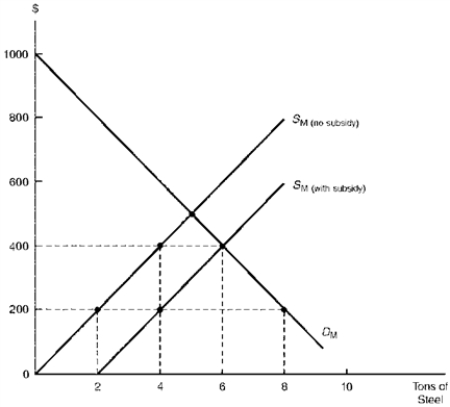

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country  -Consider Figure 5.1.Suppose the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy) . As a result of the subsidy Mexican steel producers gain ____ of producer surplus.

-Consider Figure 5.1.Suppose the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy) . As a result of the subsidy Mexican steel producers gain ____ of producer surplus.

A) $200

B) $400

C) $600

D) $800

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Consider Figure 5.5.The Japanese export quota's revenue effect totals $1200.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which trade restriction stipulates the percentage of a product's total value that must be produced domestically in order for that product to be sold domestically?

A) Import quota

B) Orderly marketing agreement

C) Local content requirement

D) Government procurement policy

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

With a quota placed on imported sugar,increased domestic demand leads to increased sugar imports but not to higher sugar prices.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If import licenses are auctioned off to domestic importers in a competitive market,their scarcity value (revenue effect) accrues to:

A) Foreign corporations

B) Foreign workers

C) Domestic corporations

D) The domestic government

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Consider Figure 5.5.With free trade,Mexicans produce 4 TVs,consume 24 TVs,and import 20 TVs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For most nations,the ratio of imports to total purchases in the public sector is much higher than in the private sector.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Concerning the restrictive impact of an import quota,assume there occurs an increase in the domestic demand for the import product.As long as the quota falls short of what would be imported under free market conditions,the economy's adjustment to the increase in demand would take the form of:

A) A decrease in domestic production of the import good

B) An increase in the amount of the good being imported

C) An increase in the domestic price of the import good

D) A decrease in domestic consumption of the import good

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An import quota tends to reduce the overall welfare of the importing nation by an amount equal to the protective effect,consumption effect,and the portion of the revenue effect that is captured by the domestic government.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

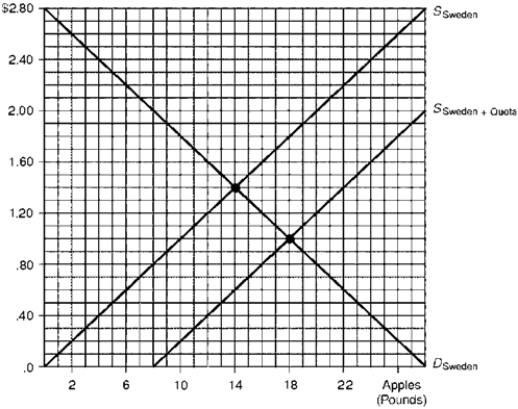

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market  -Consider Figure 5.3.After the quota is levied,the price of apples in Sweden will equal:

-Consider Figure 5.3.After the quota is levied,the price of apples in Sweden will equal:

A) $0.60 per pound

B) $1.00 per pound

C) $1.40 per pound

D) $1.80 per pound

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A global import quota permits a specified number of goods to be imported each year,but does not specify where the product is shipped from and who is permitted to import.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

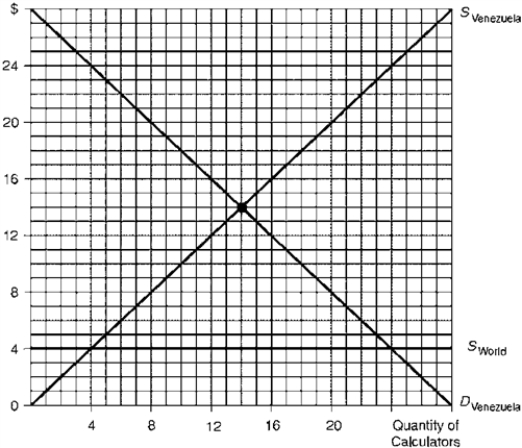

Figure 5.4.Venezuelan Calculator Market  -Consider Figure 5.4.The cost of the production subsidy to the Venezuelan government totals:

-Consider Figure 5.4.The cost of the production subsidy to the Venezuelan government totals:

A) $32

B) $40

C) $48

D) $54

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the Australian government imposes a domestic content requirement of 75 percent on autos,at least 25 percent of an auto's value must be produced in a foreign country if that auto is to be sold in Australia.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A subsidy granted to import-competing producers is intended to lead to increased domestic production and decreased imports for the home country.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sporadic (distress)dumping would occur if domestic orange producers dispose of an excess quantity of oranges,resulting from an abnormally large harvest,by selling them at lower prices abroad than at home.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Local content laws are consistent with the principle of import substitution,in which domestic production replaces the importation of goods from abroad.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

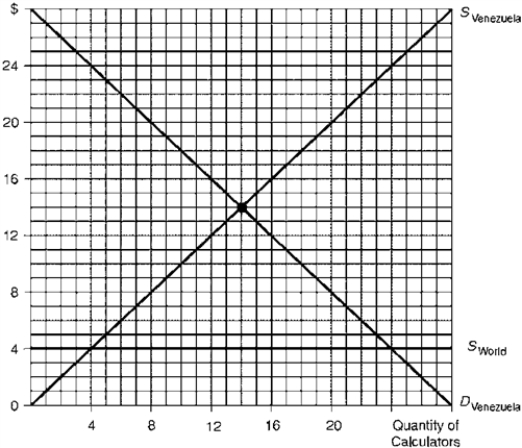

Figure 5.4.Venezuelan Calculator Market  -Consider Figure 5.4.The increase in Venezuelan producer surplus under the production subsidy totals:

-Consider Figure 5.4.The increase in Venezuelan producer surplus under the production subsidy totals:

A) $16

B) $20

C) $24

D) $32

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm that faces problems of falling sales and excess productive capacity might resort to international dumping if it:

A) Can charge higher prices in markets that are elastic to price changes

B) Earns revenues on foreign sales that at least cover variable costs

C) Can sell at that price where domestic and foreign demand elasticities equate

D) Is able to force foreign prices below marginal production costs

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Export subsidies levied by foreign governments on products in which the United States has a comparative disadvantage:

A) Lower the welfare of all Americans

B) Lead to increases in U.S.consumer surplus

C) Encourage U.S.production of competing goods

D) Encourage U.S.workers to demand higher wages

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 134

Related Exams