B) False

Correct Answer

verified

Correct Answer

verified

True/False

Any losses that are suspended under the at-risk rules are carried forward and are available during an S corporation's post-termination period.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

As a general rule, where the S corporation provisions are silent, ____________________ rules apply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 2, 2011, David loans his S corporation $10,000, and by the end of 2011 David's stock basis is zero and the basis in his note has been reduced to $8,000.During 2012, the company's operating income is $10,000.The company also makes distributions to David of $11,000.David reports a(n) :

A) $1,000 LTCG.

B) $3,000 LTCG.

C) $11,000 LTCG.

D) Loan basis of $10,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

Meeting the definition of a small business corporation is a ____________________ requirement for maintaining the S status.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which, if any, of the following can be an eligible shareholder of an S corporation?

A) A resident alien.

B) A U.S.partnership.

C) A foreign corporation.

D) None of the above can own S stock.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation shareholder's basis includes his or her direct investments plus a ratable share of any corporate liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

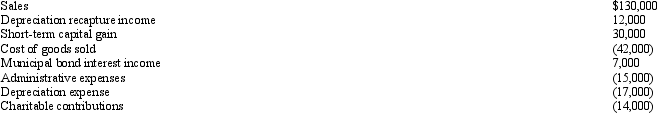

Bidden, Inc., a calendar year S corporation, incurred the following items.

Calculate Bidden's nonseparately computed income.

Calculate Bidden's nonseparately computed income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ryan is the sole shareholder of Sweetwater Apartments, an S corporation in Sour Lake, Texas.At a time when his stock basis is $10,000, the corporation distributes appreciated property worth $100,000 (basis of $10,000) .There is no built-in gain.Ryan's taxable gain is:

A) $0.

B) $10,000.

C) $90,000.

D) $100,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tax provision does not apply to an S corporation?

A) DPAD.

B) Section 1244 stock.

C) Penalty for failure to file.

D) 10% charitable contribution limitation.

E) Estimated tax payments.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The LIFO recapture tax is a variation of the passive investment income penalty tax.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For Federal income tax purposes, taxation of S corporations resembles that of partnerships.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Outline the requirements that an entity must meet to elect S corporation status.

Correct Answer

verified

If each of the follo...View Answer

Show Answer

Correct Answer

verified

View Answer

Short Answer

To make a valid S election, the entity must file a properly completed Form ____________________.

Correct Answer

verified

Correct Answer

verified

True/False

Rents always are considered to be passive investment income in S status.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Discuss the two methods of allocating tax-related items to S corporation shareholders.

Correct Answer

verified

A per-day, per-share method must be used...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

A distribution of cash or other property by an S corporation to shareholders that does not exceed the balance of AAA during a one-year period following an S election termination receives special capital gain treatment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pepper, Inc., an S corporation, reports sales revenues of $400,000, taxable interest of $380,000, operating expenses of $250,000, and deductions attributable to the interest income of $140,000.What is Pepper's passive income penalty tax payable, if any?

A) $380,000.

B) $185,000.

C) $40,895.

D) $0.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2?

A) Taxable dividends.

B) Stock dividend (taxable) .

C) Depreciation recapture income.

D) Tax-exempt income.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 159 of 159

Related Exams