B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What term is commonly used to describe the concept whereby the cost of manufactured products is composed of direct materials cost, direct labor cost, and variable factory overhead cost?

A) Absorption costing

B) Differential costing

C) Standard costing

D) Variable costing

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The factory superintendent's salary would be included as part of the cost of products manufactured under the absorption costing concept.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

On the variable costing income statement, deduction of the variable cost of goods sold from sales yields gross profit.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of inventory at the end was smaller than that at the beginning, income from operations reported under variable costing will be smaller than income from operations reported under absorption costing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of inventory at the end was larger than that at the beginning, income from operations reported under variable costing will be smaller than income from operations reported under absorption costing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In contribution margin analysis, the effect of a difference in the number of units sold, assuming no change in unit sales price or cost, is termed the unit price or unit cost factor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In determining cost of goods sold, two alternate costing concepts can be used: direct costing and variable costing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following causes the difference between the planned and actual contribution margin?

A) an increase or decrease in the amount of sales

B) an increase in the amount of variable costs and expenses

C) a decrease in the amount of variable costs and expenses

D) all of the above

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Under absorption costing, the amount of income reported from operations can be increased by producing more units than are sold.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The actual price for a product was $50 per unit, while the planned price was $44 per unit.The volume increased by 4,000 to 60,000 total units.Determine a the quantity factor and b the price factor for sales.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sales totaled $200,000 for the current year 10,000 units at $20 each and planned sales totaled $212,500 12,500 units at $17 each, the effect of the unit price factor on the change in sales is a:

A) $30,000 increase

B) $12,500 increase

C) $7,500 increase

D) $30,000 decrease

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

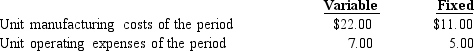

The level of inventory of a manufactured product has increased by 4,000 units during a period.The following data are also available:  What would be the effect on income from operations if absorption costing is used rather than variable costing?

What would be the effect on income from operations if absorption costing is used rather than variable costing?

A) $44,000 decrease

B) $44,000 increase

C) $64,000 increase

D) $64,000 decrease

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In contribution margin analysis, the quantity factor is computed as the difference between actual quantity sold and the planned quantity sold, multiplied by the planned unit sales price or unit cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included in the cost of a product manufactured according to absorption costing?

A) advertising expense

B) sales salaries

C) depreciation expense on factory building

D) office supplies costs

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of product manufactured equals the quantity sold, income from operations reported under absorption costing will be smaller than the income from operations reported under variable costing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It would be acceptable to have the selling price of a product just above the variable costs and expenses of making and selling it in:

A) the long run

B) the short run

C) both the short run and long run

D) neither in the short run nor the long run

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If variable cost of goods sold totaled $90,000 for the year 18,000 units at $5.00 each and the planned variable cost of goods sold totaled $86,400 16,000 units at $5.40 each, the effect of the quantity factor on the change in contribution margin is:

A) $10,800 decrease

B) $10,800 increase

C) $10,000 increase

D) $10,000 decrease

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Management should focus its sales and production efforts on the product or products that will provide

A) the highest sales revenue

B) the lowest product costs

C) the maximum contribution margin

D) the lowest direct labor hours

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In contribution margin analysis, the unit price or unit cost factor is computed as the difference between the actual unit price or unit cost and the planned unit price or unit cost, multiplied by the actual quantity sold.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 160

Related Exams