B) False

Correct Answer

verified

Correct Answer

verified

True/False

The § 1202 exclusion of gain is available on disposition of S corporation stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Randall owns 800 shares in Fabrication,Inc. ,an S corporation in Moss Hill,Texas.In 2012,his basis in his stock is $30,000,before the adjustment for this year's losses.During 2012,Randall's share of the corporation's ordinary loss is $20,000 and his share of its capital loss is $15,000.How much can Randall deduct due to these losses?

A) No deduction.

B) $15,000 ordinary loss;$10,000 capital loss.

C) $17,143 ordinary loss;$12,857 capital loss.

D) $20,000 ordinary loss;$15,000 capital loss.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A new S corporation shareholder can revoke the S election unilaterally,if he/she owns how much of the existing S corporation's stock?

A) More than 50%.

B) 50% or more.

C) The election can be revoked only if all of the shareholders consent.

D) The election cannot be revoked during the first year of the new shareholder's ownership.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

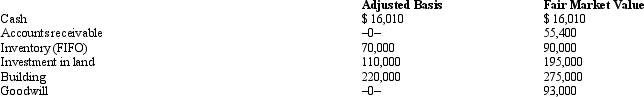

Blue Corporation elects S status effective for tax year 2012.As of January 1,2012,Blue's assets were appraised as follows.

Correct Answer

verified

Correct Answer

verified

True/False

Most IRAs can own stock in an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Any losses that are suspended under the at-risk rules are carried forward and are available during an S corporation's post-termination period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's stock basis includes a ratable share of any S corporation liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2?

A) Charitable contributions.

B) Unreasonable compensation.

C) Payroll tax penalty assessed.

D) Domestic production activities deduction.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Where the S corporation rules are silent,partnership rules apply to the S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item does not appear on Schedule K of Form 1120S?

A) Intangible drilling costs.

B) Foreign loss.

C) Utilities expense.

D) Recovery of a tax benefit.

E) All of the above items appear on Schedule K.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The LIFO recapture tax is a variation of the passive investment income penalty tax.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Any distribution of cash or property by a corporation that does not exceed the balance of AAA with respect to the stock during a post-termination transition period of approximately one year is applied against and reduces the adjusted basis of the stock.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

An S corporation recognizes a ____________________ on any distribution of appreciated property.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 154 of 154

Related Exams