B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average rate of return for this investment is

A) 18%.

B) 16%.

C) 58%.

D) 20%.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

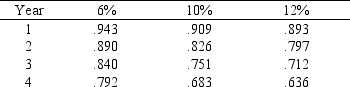

The rate of earnings is 10% and the cash to be received in one year is $10,000.Determine the present value amount,using the following partial table of present value of $1 at compound interest:

A) $8,930

B) $9,000

C) $9,430

D) $9,090

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process by which management plans,evaluates,and controls long-term investment decisions involving fixed assets is called

A) absorption cost analysis.

B) variable cost analysis.

C) capital investment analysis.

D) cost-volume-profit analysis.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payback period is determined using which of the following formulas?

A) Amount to be invested/Annual average net income

B) Annual net cash flow/Amount to be invested

C) Annual average net income/Amount to be invested

D) Amount to be invested/Equal annual net cash flows

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

True/False

When evaluating a proposal by use of the cash payback method,if net cash flows exceed the capital investment within the time deemed acceptable by management,the proposal should be accepted.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the following partial table of present value of $1 at compound interest,determine the present value of $20,000 to be received four years hence,with earnings at the rate of 10%

A year.

A) $13,660

B) $12,720

C) $15,840

D) $10,400

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the following partial table of present value of $1 at compound interest,determine the present value of $20,000 to be received four years hence with earnings at the rate of 12% a year:

A) $13,660

B) $15,840

C) $12,720

D) $10,400

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Qualitative considerations are best evaluated using present value methods such as internal rate of return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In general,present value methods of analyzing capital investments are more desirable than methods ignoring present value because

A) the calculations in methods that ignore present value are more complex than those in methods using present value.

B) the present value methods consider that a dollar today is worth more than a dollar in the future due to the potential earning power of that dollar.

C) the calculations in methods that consider present value are less complex than those methods ignoring present value.

D) the present value methods consider that a dollar in the future is worth more than a dollar today due to the potential earning power of that dollar.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method of evaluating capital investment proposals uses the concept of present value to compute a rate of return?

A) Average rate of return

B) Internal rate of return

C) Cash payback period

D) Accounting rate of return

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The anticipated purchase of a fixed asset for $400,000 with a useful life of 5 years and no residual value is expected to yield total income of $150,000.The expected average rate of return,giving effect to depreciation on investment,is 15%.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume in analyzing alternative proposals that Proposal F has a useful life of six years and Proposal J has a useful life of nine years.What is one widely used method that makes the proposals comparable?

A) Ignore the fact that Proposal F has a useful life of six years and treat it as if it has a useful life of nine years.

B) Adjust the life of Proposal J to a time period that is equal to that of Proposal F by estimating a residual value at the end of year six.

C) Ignore the useful lives of six and nine years and find an average (7 1/2 years) .

D) Ignore the useful lives of six and nine years and compute the average rate of return.

F) None of the above

Correct Answer

verified

B

Correct Answer

verified

True/False

The process by which management allocates available investment funds among competing capital investment proposals is termed present value analysis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Average rate of return equals estimated average annual income divided by average investment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process by which management allocates available investment funds among competing investment proposals is called

A) investment capital.

B) investment rationing.

C) cost-volume-profit analysis.

D) capital rationing.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected average rate of return for a proposed investment of $3,000,000 in a fixed asset giving effect to depreciation (straight-line method) with a useful life of 20 years,no residual value,and an expected total income of $6,000,000 is

A) 25%.

B) 18%.

C) 40%.

D) 20%.

F) B) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

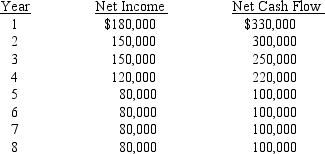

An anticipated purchase of equipment for $1,200,000,with a useful life of 8 years and no residual value,is expected to yield the following annual net incomes and net cash flows:

What is the cash payback period?

What is the cash payback period?

A) 5 years

B) 4 years

C) 6 years

D) 3 years

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following qualitative considerations may impact upon capital investments analysis EXCEPT

A) time value of money.

B) employee morale.

C) the impact on product quality.

D) manufacturing flexibility.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Care must be taken involving capital investment decisions since normally a long-term commitment of funds is involved and operations could be affected for many years.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 103

Related Exams