A) liabilities.

B) assets.

C) expenses.

D) cash flow from financing activities.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For EFG Co. ,the transaction "Receipt of a utility bill" would

A) increase total assets.

B) decrease total assets.

C) have no effect on total assets.

D) decrease total liabilities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For EFG Co. ,the transaction "Purchase of store equipment with a note payable" would

A) increase total assets.

B) decrease total assets.

C) have no effect on total assets.

D) decrease total liabilities.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

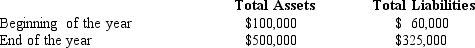

Exhibit 2-1

-Refer to Exhibit 2-1.What is net income,assuming no stock was issued and dividends of $25,000 were paid?

-Refer to Exhibit 2-1.What is net income,assuming no stock was issued and dividends of $25,000 were paid?

A) $110,000

B) $150,000

C) $160,000

D) $200,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gibbs Company has $16,000 in Retained Earnings,$27,000 in Assets,and $5,000 in Liabilities.How much is in Common Stock?

A) $22,000

B) $16,000

C) $11,000

D) $6,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When an account receivable is collected in cash,the total assets of the business increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Johnson,Inc.purchased land for cash.What effect does this transaction have on the following accounts:

A) Increase in Cash and decrease in Land

B) Decrease in Cash and decrease in Land

C) Increase in Cash and increase in Land

D) Decrease in Cash and increase in Land

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The basic elements of a financial accounting system include a framework for preparing financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A __________ is an economic event that under generally accepted accounting principles affects an element of the financial statements and must be recorded.

A) framework

B) control

C) set of rules

D) transaction

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For EFG Co. ,the transaction "Payment of interest expense" would

A) increase total assets.

B) decrease total assets.

C) have no effect on total assets.

D) increase stockholders' equity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following situations increase stockholders' equity?

A) Supplies are purchased on account.

B) Services are provided on account.

C) Cash is received from customers.

D) Utility bill will be paid next month.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For EFG Co. ,the transaction "Payment to creditors" would

A) increase total assets.

B) decrease total assets.

C) have no effect on total assets.

D) decrease stockholders' equity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income statement for August indicates net income of $50,000.The corporation also paid $10,000 in dividends during the same period.If there was no beginning balance in stockholders' equity,what is the ending balance in stockholders' equity?

A) $40,000

B) $50,000

C) $10,000

D) $60,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A to Z Corporation engaged in the following transaction "Paid a $10,000 cash dividend." On the Statement of Cash Flows,the transaction would be classified as

A) Cash Flows from Operating Activities.

B) Cash Flows from Investing Activities.

C) Cash Flows from Financing Activities.

D) Noncash transaction.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a $15,000 purchase of equipment for cash is incorrectly recorded as an increase to equipment and as an increase to cash,at the end of the period assets will

A) exceed liabilities and stockholders' equity by $15,000.

B) equal liabilities and stockholders' equity.

C) exceed liabilities and stockholders' equity by $30,000.

D) exceed liabilities and stockholders' equity by $40,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flow,Inc.received cash from fees earned.How does this transaction affect the Statement of Cash Flows?

A) Increase cash from Operating Activities

B) Increase cash from Investing Activities

C) Increase cash from Financing Activities

D) No effect on the Statement of Cash Flows

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will increase stockholders' equity?

A) Expenses > revenues

B) Owner investment

C) Accounts payable

D) Dividends

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When an accounts payable account is paid in cash,the stockholders' equity in the business increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For EFG Co. ,the transaction "Payment of dividends" would

A) increase total assets.

B) decrease total assets.

C) have no effect on total assets.

D) increase stockholders' equity.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payment of a liability

A) decreases assets and stockholders' equity.

B) increases assets and decreases liabilities.

C) decreases assets and increases liabilities.

D) decreases assets and decreases liabilities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 88

Related Exams