Correct Answer

verified

Correct Answer

verified

Essay

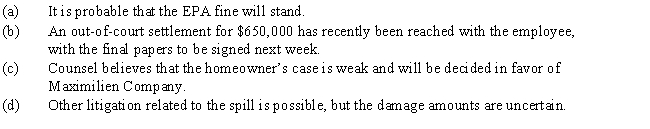

Several months ago,Maximilien Company experienced a spill of radioactive materials into the Missouri River from one of its plants.As a result,the Environmental Protection Agency

(EPA)fined the company $1,750,000.The company contested the fine.In addition,an employee is seeking $975,000 damages related to the spill.Finally,a homeowner has sued the company for $580,000.Although the homeowner lives 15 miles downstream from the plant,he believes that the spill has reduced his home's resale value by $580,000.Maximilien's legal counsel believes the following will happen in relationship to these incidents:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the term or phrase (a-g) that best describes it. Terms or phrases may be used more than once. -Current assets - Current liabilities

A) Current ratio

B) Working capital

C) Quick assets

D) Quick ratio

E) Record an accrual and disclose in the notes to the financial statements

F) Disclose only in notes to financial statements

G) No disclosure needed in notes to financial statements

I) D) and G)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quick assets include

A) cash, cash equivalents, receivables, prepaid expenses, and inventory

B) cash, cash equivalents, receivables, and prepaid expenses

C) cash, cash equivalents, receivables, and inventory

D) cash, cash equivalents, and receivables

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 8,Williams Company issued an $80,000,5%,120-day note payable to Brown Industries.Assuming a 360-day year,what is the maturity value of the note?

A) $82,600

B) $84,000

C) $81,333

D) $88,200

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each payroll item that follows to the one item (a-f) that best describes its characteristics. -Federal unemployment compensation tax (FUTA)

A) Amount is limited, withheld from employee only

B) Amount is limited, withheld from employee and matched by employer

C) Amount is limited, paid by employer only

D) Amount is not limited, withheld from employee only

E) Amount is not limited, withheld from employee and matched by employer

F) Amount is not limited, paid by employer only

H) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the term or phrase (a-g) that best describes it. Terms or phrases may be used more than once. -Cash + Temporary investments + Accounts receivable

A) Current ratio

B) Working capital

C) Quick assets

D) Quick ratio

E) Record an accrual and disclose in the notes to the financial statements

F) Disclose only in notes to financial statements

G) No disclosure needed in notes to financial statements

I) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Most employers use payroll checks drawn on a special bank account for paying the payroll.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Form W-4 is a form authorizing employers to withhold a portion of employee earnings for payment of an employee's federal income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

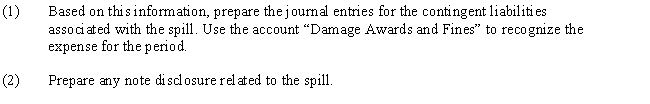

Use this information for Harris Company to answer the following questions.

Assuming no employees are subject to ceilings for their earnings, Harris Company has the following information for the pay period of January 15-31.

-Assuming that all wages are subject to federal and state unemployment taxes,the employer's payroll tax expense would be

-Assuming that all wages are subject to federal and state unemployment taxes,the employer's payroll tax expense would be

A) $1,370

B) $750

C) $620

D) $2,870

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee receives an hourly wage rate of $15,with time-and-a-half for all hours worked in excess of 40 during the week.Payroll data for the current week are as follows: hours worked,48; federal income tax withheld,$120; social security tax rate,6.0%; Medicare tax rate,1.5%; state unemployment compensation tax,3.4% on the first $7,000; and federal unemployment compensation tax,0.8% on the first $7,000.What is the net amount to be paid to the employee?

A) $568.74

B) $601.50

C) $660.00

D) $574.90

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zennia Company provides its employees with varying amounts of vacation per year,depending on their length of employment.The estimated amount of the current year's vacation cost is $135,000.On December 31,the end of the current year,the current month's accrued vacation pay is

A) $135,000

B) $67,500

C) $0

D) $11,250

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record pension rights that have not been funded for its salaried employees at the end of the year is

A) debit Salaries Expense; credit Cash

B) debit Pension Expense; credit Unfunded Pension Liability

C) debit Pension Expense; credit Unfunded Pension Liability and Cash

D) debit Pension Expense; credit Cash

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of a product warranty should be included as an expense in the

A) period the cash is collected for a product sold on account

B) future period when the cost of repairing the product is paid

C) period of the sale of the product

D) future period when the product is repaired or replaced

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The amount borrowed is equal to the face amount of the note on an interest-bearing note payable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The detailed record indicating the data for each employee for each payroll period and the cumulative total earnings for each employee is called the

A) payroll register

B) payroll check

C) employee's earnings record

D) employer's earnings record

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Estimating and recording product warranty expense in the period of the sale best follows the

A) cost concept

B) business entity concept

C) matching concept

D) materiality concept

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following key (a-d) to identify the proper treatment of each contingent liability. -Event is reasonably possible and amount is estimable

A) Record only

B) Record and disclose

C) Disclose only

D) Do not record or disclose

![]()

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each payroll item that follows to the one item (a-f) that best describes its characteristics. -FICA-Medicare

A) Amount is limited, withheld from employee only

B) Amount is limited, withheld from employee and matched by employer

C) Amount is limited, paid by employer only

D) Amount is not limited, withheld from employee only

E) Amount is not limited, withheld from employee and matched by employer

F) Amount is not limited, paid by employer only

H) D) and F)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chang Co.issued a $50,000,120-day,discounted note to Guarantee Bank.The discount rate is 6%.Assuming a 360-day year,the cash proceeds to Chang Co.are

A) $49,750

B) $47,000

C) $49,000

D) $51,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 197

Related Exams