A) Supplies

B) Accounts Receivable

C) Unearned Subscriptions

D) Unearned Fees

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

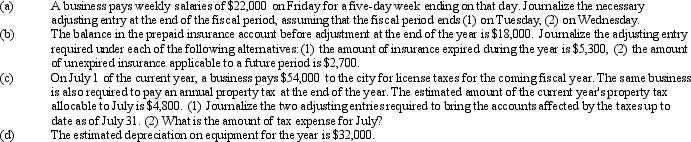

For each of the following,journalize the necessary adjusting entry:

Correct Answer

verified

Correct Answer

verified

True/False

A company depreciates its equipment $500 a year.The adjusting entry for December 31 is credit Depreciation Expense,$500 and debit Equipment,$500.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

At the end of April,the first month of the year,the usual adjusting entry transferring rent earned to a revenue account from the unearned rent account was omitted.Indicate which items will be incorrectly stated,because of the error,on (a)the income statement for April and (b)the balance sheet as of April 30.Also indicate whether the items in error will be overstated or understated.

Correct Answer

verified

Correct Answer

verified

True/False

A fixed asset's market value is reflected in the Balance Sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By matching revenues and expenses in the same period in which they incur

A) net income or loss will always be underestimated.

B) net income or loss will always be overestimated.

C) net income or loss will be properly reported on the income statement

D) net income or loss will not be determined.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the adjustment to recognize expired insurance at the end of the period is inadvertently omitted,the assets at the end of the period will be understated.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On January 2nd,Dog Mart prepaid $30,000 rent for the year and recorded the prepayment in an asset account.Prepare the January 31st adjusting entry for rent expense.

Correct Answer

verified

Correct Answer

verified

Essay

The prepaid insurance account had a beginning balance of $6,600 and was debited for $2,300 of premiums paid during the year.Journalize the adjusting entry required at the end of the year assuming the amount of unexpired insurance related to future periods is $4,100.

Correct Answer

verified

11ea906a_d1cd_315f_aec7_39e1d2bb4f1c_TB2051_00 $6,600 + $2,300 - $4,100 = $4,800

Correct Answer

verified

Multiple Choice

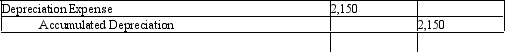

What effect will the following adjusting journal entry have on the accounting records?

A) increase net income

B) increase revenues

C) decrease expenses

D) decrease net book value

F) None of the above

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Which account would normally not require an adjusting entry?

A) Wages Expense

B) Accounts Receivable

C) Accumulated Depreciation

D) Retained Earnings

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A contra asset account for Land will normally appear in the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to adjust the accounts for wages accrued at the end of the accounting period is

A) debit Wages Payable;credit Wages Income

B) debit Wages Income;credit Wages Payable

C) debit Wages Payable;credit Wages Expense

D) debit Wages Expense;credit Wages Payable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business pays bi-weekly salaries of $20,000 every other Friday for a ten-day period ending on that day.The adjusting entry necessary at the end of the fiscal period ending on the second Wednesday of the pay period includes a:

A) debit to Salary Expense of $8,000.

B) debit to Salary Payable of $8,000

C) credit to Salary Expense of $16,000

D) credit to Salary Payable of $16,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Ski Master Company pays weekly salaries of $18,000 on Friday for a five-day week ending on that day.Journalize the necessary adjusting entry at the end of the accounting period,assuming that the period ends on Wednesday.

Correct Answer

verified

Correct Answer

verified

True/False

Revenue recognition concept requires that the reporting of revenue be included in the period when cash for the service is received.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally accepted accounting principles requires that companies use the ____ of accounting.

A) cash basis

B) deferral basis

C) accrual basis

D) account basis

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the adjustment of the unearned rent account at the end of the period to recognize the amount of rent earned is inadvertently omitted,the net income for the period will be understated.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

The net book value of a fixed asset is determined by

A) original cost less accumulated depreciation

B) original cost less depreciation expense

C) original cost less accumulated depreciation plus depreciation expense

D) original cost plus accumulated depreciation

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the adjustment for depreciation for the year is inadvertently omitted,the assets on the balance sheet at the end of the period will be understated.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 169

Related Exams