Filters

Question type

A) $4.50 and $0.25

B) $3.25 and $0.25

C) $4.50 and $0.90

D) $2.00 and $0.25

E) B) and D)

F) B) and C)

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Question 92

True/False

Under the Internal Revenue Code,corporations are required to pay federal income taxes.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 93

Multiple Choice

A corporation issues 2,500 shares of common stock for $ 45,000.The stock has a stated value of $10 per share.The journal entry to record the stock issuance would include a credit to Common Stock for

A) $25,000

B) $45,000

C) $20,000

D) $ 5,000

E) A) and D)

F) A) and C)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Question 94

True/False

Double taxation is a disadvantage of a corporation because the same party has to pay taxes twice on the income.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 95

True/False

A large retained earnings account means that there is cash available to pay dividends.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 96

True/False

Before a stock dividend can be declared or paid,there must be sufficient cash.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 97

True/False

One of the prerequisites to paying a cash dividend is sufficient retained earnings.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 98

Multiple Choice

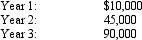

Sabas Company has 20,000 shares of $100 par,2% cumulative preferred stock and 100,000 shares of $50 par common stock.The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for the second year.

Determine the dividends per share for preferred and common stock for the second year.

A) $2.25 and $0.00

B) $2.25 and $0.45

C) $0.00 and $0.45

D) $2.00 and $0.45

E) None of the above

F) A) and D)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Question 99

True/False

A large public corporation normally uses registrars and transfer agents to maintain records of the stockholders.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 169 of 169

Related Exams