B) False

Correct Answer

verified

Correct Answer

verified

True/False

If 20,000 shares are authorized, 15,000 shares are issued, and 500 shares are held as treasury stock, a cash dividend of $1 per share would amount to $15,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A corporation has 10,000 shares of $100 par value stock outstanding. If the corporation issues a 5-for-1 stock split, the number of shares outstanding after the split will be 40,000.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On February 1 of the current year, Motor, Inc. issued 700 shares of $2 par common stock to an attorney in return for preparing and filing the Articles of Incorporation. The value of the services is $9,600. Journalize this transaction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Everly Company issues 1,000 shares of $5 par value common stock for $75,000, the account

A) Common Stock will be credited for $75,000.

B) Paid-in Capital in excess of Par Value will be credited for $5,000.

C) Paid-in Capital in excess of Par Value will be credited for $70,000.

D) Cash will be debited for $70,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

On May 10, a company issued for cash 1,500 shares of no-par common stock (with a stated value of $2) at $14, and on May 15, it issued for cash 2,000 shares of $15 par preferred stock at $58. Journalize the entries for May 10 and 15, assuming that the common stock is to be credited with the stated value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alma Corp. issues 1,000 shares of $10 par value common stock at $14 per share. When the transaction is recorded, credits are made to:

A) Common Stock $14,000.

B) Common Stock $10,000 and Paid-in Capital in Excess of Par Value $4,000.

C) Common Stock $4,000 and Paid-in Capital in Excess of Stated Value $10,000.

D) Common Stock $10,000 and Retained Earnings $4,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The liability for a dividend is recorded on which of the following dates?

A) the date of record

B) the date of payment

C) the last day of the fiscal year

D) the date of declaration

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 20xx, Swenson Corporation had 40,000 shares of $10 par value common stock issued and outstanding. All 40,000 shares had been issued in a prior period at $20.00 per share. On February 1, 20xx, Swenson purchased 4,000 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on March 1, 20xx. The journal entry to record the purchase of the treasury shares on February 1, 20xx, would include a

A) credit to Treasury Stock for $96,000.

B) debit to Treasury Stock for $96,000.

C) debit to a loss account for $120,000

D) credit to a gain account for $120,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

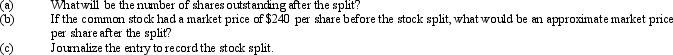

A corporation, which had 18,000 shares of common stock outstanding, declared a 3-for-1 stock split.

Correct Answer

verified

Correct Answer

verified

Essay

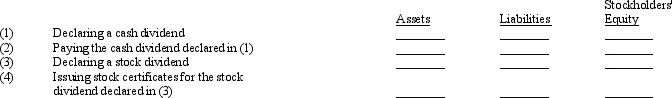

Indicate whether the following actions would (+) increase, (-) decrease, or (0) not affect a company's total assets, liabilities, and stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price at which a stock can be sold depends upon a number of factors. Which statement below is not one of those factors?

A) the financial condition, earnings record, and dividend record of the corporation

B) investor expectations of the corporation's earning power

C) how high the par value is

D) general business and economic conditions and prospects

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability of a corporation to obtain capital is

A) less than a partnership.

B) about the same as a partnership.

C) restricted because of the limited life of the corporation.

D) enhanced because of limited liability and ease of share transferability.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A corporation has 12,000 shares of $20 par value stock outstanding that has a current market value of $150. If the corporation issues a 4-for-1 stock split, the market value of the stock will fall to approximately $50.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a corporation issues stock at a premium, it reports the premium as an other income item on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

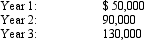

Sabas Company has 40,000 shares of $100 par, 1% preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

Correct Answer

verified

Correct Answer

verified

True/False

When no-par stock is issued, the Common Stock account is credited for the selling price of the stock issued.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Retained earnings

A) is the same as contributed capital

B) cannot have a debit balance

C) changes are summarized in the retained earnings statement

D) is equal to cash on hand

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Dayton Corporation began the current year with a retained earnings balance of $32,000. During the year, the company corrected an error made in the prior year, which was a failure to record depreciation expense of $3,000 on equipment. Also, during the current year, the company earned net income of $12,000 and declared cash dividends of $7,000. Compute the year end retained earnings balance.

A) $34,000

B) $37,000

C) $41,000

D) $44,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When the board of director's declares a cash or stock dividend, this action decreases retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 165

Related Exams