B) False

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling caused the gasoline shortage of 1973 in the United States.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government passes a law requiring sellers of mopeds to send $200 to the government for every moped they sell, then

A) the supply curve for mopeds shifts downward by $200.

B) sellers of mopeds receive $200 less per moped than they were receiving before the tax.

C) buyers of mopeds are unaffected by the tax.

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product, then there will be an)

A) upward shift of the demand curve.

B) downward shift of the demand curve.

C) movement up and to the left along the demand curve.

D) movement down and to the right along the demand curve.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a nonbinding price ceiling is imposed on a market, then the

A) quantity sold in the market will decrease.

B) quantity sold in the market will stay the same.

C) price in the market will increase.

D) price in the market will decrease.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on sellers of tea,

A) the well-being of both sellers and buyers of tea is unaffected.

B) sellers of tea are made worse off, and the well-being of buyers is unaffected.

C) sellers of tea are made worse off, and buyers of tea are made better off.

D) both sellers and buyers of tea are made worse off.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

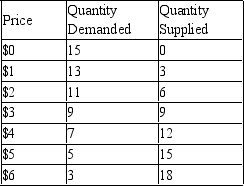

Table 6-3

The following table contains the demand schedule and supply schedule for a market for a particular good. Suppose sellers of the good successfully lobby Congress to impose a price floor $2 above the equilibrium price in this market.

-Refer to Table 6-3. Following the imposition of a price floor $2 above the equilibrium price, irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor. The resulting shortage is

-Refer to Table 6-3. Following the imposition of a price floor $2 above the equilibrium price, irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor. The resulting shortage is

A) 0 units.

B) 2 units.

C) 5 units.

D) 7 units.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

There are several criticisms of the minimum wage. Which of the following is not one of those criticisms? The minimum wage

A) often hurts those people who it is intended to help.

B) results in an excess supply of low-skilled labor.

C) prevents some unskilled workers from getting needed on-the-job training.

D) fails to raise the wage of any employed person.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the buyers of tennis racquets, the size of the tennis racquet market

A) and the price paid by buyers both decrease.

B) decreases, but the price paid by buyers increases.

C) increases, but the price paid by buyers decreases.

D) and the price paid by buyers both increase.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Taxes levied on sellers and taxes levied on buyers are equivalent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of coffee mugs

A) increases the size of the coffee mug market.

B) decreases the size of the coffee mug market.

C) has no effect on the size of the coffee mug market.

D) may increase, decrease, or have no effect on the size of the coffee mug market.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

To be binding, a price ceiling must be set above the equilibrium price.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers shifts the demand curve and the supply curve.

B) False

Correct Answer

verified

Correct Answer

verified

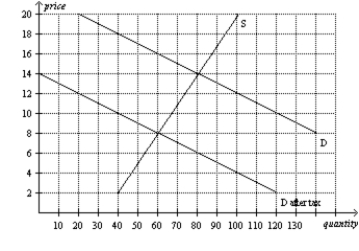

Multiple Choice

Figure 6-26  -Refer to Figure 6-26. How much tax revenue does this tax produce for the government?

-Refer to Figure 6-26. How much tax revenue does this tax produce for the government?

A) $480

B) $640

C) $360

D) $120

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a payroll tax is enacted, the wage received by workers

A) falls, and the wage paid by firms rises.

B) falls, and the wage paid by firms falls.

C) rises, and the wage paid by firms falls.

D) rises, and the wage paid by firms rises.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on a market with elastic demand and elastic supply will shrink the market more than a tax on a market with inelastic demand and inelastic supply will shrink the market.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a tax of $1.00 per gallon is imposed on sellers of gasoline, the supply curve for gasoline shifts upward, but by less than $1.00.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a $2 tax on buyers of cigars and imposes the same $2 tax on sellers of cigars, then the price paid by buyers will

A) not change, and the price received by sellers will not change.

B) not change, and the price received by sellers will decrease.

C) decrease, and the price received by sellers will not change.

D) decrease, and the price received by sellers will decrease.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct? In a 2006 survey of Ph.D. economists,

A) 47 percent favored eliminating the minimum wage.

B) 14 percent would maintain the minimum wage at its current level.

C) 38 percent would increase the minimum wage.

D) 10 percent would decrease the minimum wage.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a 25-cent tax on the buyers of incandescent light bulbs. Which of the following is not correct? The tax would

A) shift the demand curve downward by 25 cents.

B) lower the equilibrium price by 25 cents.

C) reduce the equilibrium quantity.

D) discourage market activity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 648

Related Exams