B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rent control

A) serves as an example of how a social problem can be alleviated or even solved by government policies.

B) serves as an example of a price ceiling.

C) is regarded by most economists as an efficient way of helping the poor.

D) is the most efficient way to allocate scarce housing resources.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product, then the supply curve will

A) not shift.

B) shift up.

C) shift down.

D) become flatter.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Whether a tax is levied on sellers or buyers, buyers and sellers usually share the burden of taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

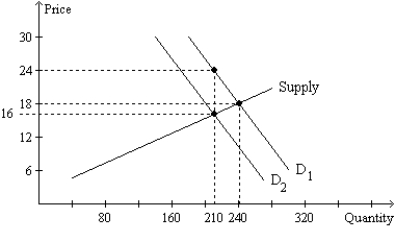

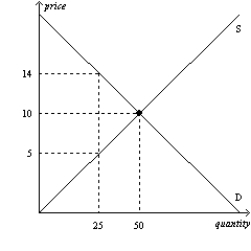

Figure 6-24  -Refer to Figure 6-24. The per-unit burden of the tax on buyers of the good is

-Refer to Figure 6-24. The per-unit burden of the tax on buyers of the good is

A) $2.

B) $4.

C) $6.

D) $8.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Studies by economists have found that a 10 percent increase in the minimum wage decreases teenage employment 10 percent.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers shifts the supply curve but not the demand curve.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a short-run effect of rent control on the housing market?

A) reduced rents

B) a large shortage

C) a small increase in quantity demanded

D) a small decrease in quantity supplied

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

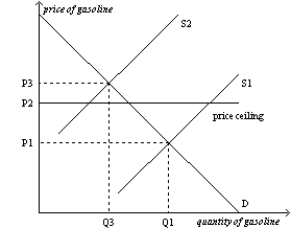

Figure 6-12  -Refer to Figure 6-12. Which of the following statements best relates the figure to the events that occurred in the United States in the 1970s?

-Refer to Figure 6-12. Which of the following statements best relates the figure to the events that occurred in the United States in the 1970s?

A) Buyers of gasoline paid a price of P1 before 1973; they paid a price of P2 after OPEC increased the price of crude oil in 1973, and there was a shortage of gasoline at that price.

B) Buyers of gasoline paid a price of P1 before 1973; they paid a price of P3 after OPEC increased the price of crude oil in 1973, and there was a shortage of gasoline at that price.

C) Buyers of gasoline paid a price of P2 before 1973; they paid a price of P3 after OPEC increased the price of crude oil in 1973, with no shortage of gasoline at that price.

D) The price ceiling was binding before 1973; the price ceiling was no longer binding after OPEC increased the price of crude oil in 1973.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price ceiling is imposed on a market to benefit buyers,

A) no buyers actually benefit.

B) some buyers benefit, but no buyers are harmed.

C) some buyers benefit, and some buyers are harmed.

D) all buyers benefit.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

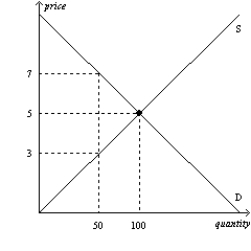

Multiple Choice

Figure 6-19  -Refer to Figure 6-19. Suppose a tax of $2 per unit is imposed on this market. How much will sellers receive per unit after the tax is imposed?

-Refer to Figure 6-19. Suppose a tax of $2 per unit is imposed on this market. How much will sellers receive per unit after the tax is imposed?

A) $3

B) between $3 and $5

C) between $5 and $7

D) $7

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An outcome that can result from either a price ceiling or a price floor is

A) a surplus in the market.

B) a shortage in the market.

C) a nonbinding price control.

D) long lines of frustrated buyers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the sellers of cell phones, the size of the cell phone market

A) and the effective price received by sellers both increase.

B) increases, but the effective price received by sellers decreases.

C) decreases, but the effective price received by sellers increases.

D) and the effective price received by sellers both decrease.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum-wage laws dictate the

A) average price employers must pay for labor.

B) highest price employers may pay for labor.

C) lowest price employers may pay for labor.

D) the highest and lowest prices employers may pay for labor.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The goal of the minimum wage is to ensure workers a minimally adequate standard of living.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

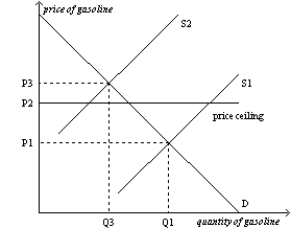

Figure 6-12  -Refer to Figure 6-12. When the price ceiling applies in this market and the supply curve for gasoline shifts from S1 to S2,

-Refer to Figure 6-12. When the price ceiling applies in this market and the supply curve for gasoline shifts from S1 to S2,

A) the market price will increase to P3.

B) a surplus will occur at the new market price of P2.

C) the market price will stay at P1.

D) a shortage will occur at the new market price of P2.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sellers of a good bear the larger share of the tax burden when a tax is placed on a product for which the i) supply is more elastic than the demand. Ii) demand in more elastic than the supply. Iii) tax is placed on the sellers of the product. Iv) tax is placed on the buyers of the product.

A) i) only

B) ii) only

C) i) and iv) only

D) ii) and iii) only

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

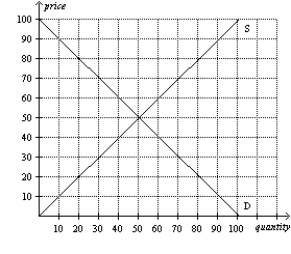

Figure 6-35  -Refer to Figure 6-35. A price floor set at $40 would create a surplus of 20 units.

-Refer to Figure 6-35. A price floor set at $40 would create a surplus of 20 units.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following observations would be consistent with the imposition of a binding price ceiling on a market? After the price ceiling becomes effective,

A) a smaller quantity of the good is bought and sold.

B) a smaller quantity of the good is demanded.

C) a larger quantity of the good is supplied.

D) the price rises above the previous equilibrium.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-20  -Refer to Figure 6-20. Suppose a tax of $5 per unit is imposed on this market. Which of the following is correct?

-Refer to Figure 6-20. Suppose a tax of $5 per unit is imposed on this market. Which of the following is correct?

A) Buyers and sellers will share the burden of the tax equally.

B) Buyers will bear more of the burden of the tax than sellers will.

C) Sellers will bear more of the burden of the tax than buyers will.

D) Any of the above is possible.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 648

Related Exams