B) False

Correct Answer

verified

Correct Answer

verified

True/False

Pass-through S corporation losses can reduce the basis in the shareholder's loan to the entity, but distributions do not reduce loan basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cash basis calendar year C corporation reports $100,000 of accounts receivable on the date of its conversion to S status on February 14. By the end of the year, $60,000 of these receivables are collected. Calculate any built-in gains tax, assuming that there is sufficient taxable income.

A) $0

B) $10,000

C) $21,000

D) $35,000

E) Some other amount

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

An S corporation's LIFO recapture amount equals the excess of the inventory's value under ____________________ over the ____________________ value.

Correct Answer

verified

Correct Answer

verified

True/False

Any distribution made by an S corporation during a tax year is taken into account before accounting for the year's losses.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Liabilities affect the owner's basis differently in an S corporation than they do in a partnership.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Tax-exempt income is listed on Schedule ____________________and of Form 1120S.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

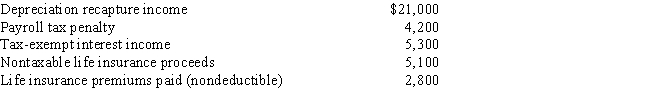

If an S corporation's beginning balance in OAA is zero, and the following transactions occur, what is the ending OAA balance?

A) $1,300

B) $7,600

C) $23,300

D) $27,500

E) None of the above

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The LIFO recapture tax is a variation of the passive investment income penalty tax.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Non-separately computed loss ____________________ a S shareholder's stock basis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An S corporation must possess which of the following characteristics?

A) Not more than one hundred shareholders.

B) Corporation organized in the U.S.

C) Only one class of stock.

D) All of the above are required of an S corporation.

E) None of the above are required of an S corporation.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

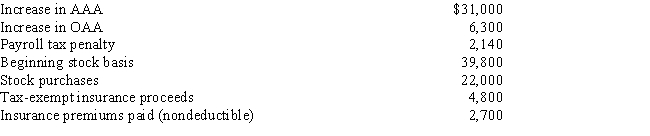

You are given the following facts about a solely owned S corporation. What is the shareholder's ending stock basis?

A) $61,800

B) $68,100

C) $99,100

D) $100,100

E) Some other amount

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are given the following facts about a 50% owner of an S corporation. Compute her ending stock basis.

A) $80,950

B) $85,750

C) $100,100

D) $106,225

E) Some other amount

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A distribution of cash or other property by an S corporation to shareholders that does not exceed the balance of AAA during a one-year period following an S election termination receives special capital gain treatment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item has no effect on an S corporation's AAA?

A) Stock purchase by a shareholder.

B) Interest expense.

C) Cost of goods sold.

D) Capital loss.

E) All of the above modify AAA.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A per-day, per-share allocation of flow-through S corporation items must be used, unless the shareholder disposes of the entire interest in the entity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a resident alien shareholder moves outside the U.S., the S election is terminated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Samantha owned 1,000 shares in Evita, Inc., an S corporation, that uses the calendar year. On October 11, Samantha sells all of her Evita stock. Her stock basis at the beginning of the tax year was $60,000. Evita's ordinary income for the year was $22,000, and she receives a distribution of $35,000 on May 3rd. Her stock basis at the time of the sale is:

A) $117,000.

B) $82,000.

C) $60,000.

D) $47,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which, if any, of the following can be eligible shareholders of an S corporation?

A) A Roth IRA.

B) Partnership.

C) A non-U.S. corporation.

D) A nonqualifying trust.

E) None of the above can own stock.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Essay

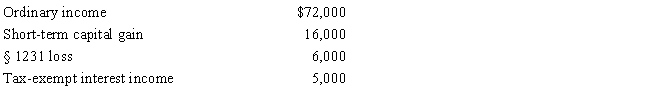

Gene Grams is a 45% owner of a calendar year S corporation during the tax year. His beginning stock basis is $230,000, and the S corporation reports the following items.

Calculate Grams's stock basis at year-end.

Calculate Grams's stock basis at year-end.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 145

Related Exams